Books can literally change your life and one of the most influential ones for me has to be “Think and Grow Rich” by Napoleon Hill. I love this book so much, for so many reasons. One big reason is because it taught me this: I need to teach my kids about money.

Not that a quarter equals 25 cents or how to make change from a dollar. That’s covered in school. But they are never taught money’s true value, its importance, how to earn it, save it, give it, and invest it. Our school system fails them miserably in this regard. So most kids grow up learning all about isosceles triangles and chlorophyll, but not how to manage money.

Let them be little, but informed

It seriously took reading Napoleon Hill’s book to help me realize that I need to do something about it. I couldn’t justify allowing my kids to be ignorant any longer. We think “let them be little. They shouldn’t worry about that adult stuff now.” But, after reading Think and Grow Rich, I 100% disagree.

Now is the time to educate them. When their brains are still hungry for knowledge, and they haven’t opened a credit card yet. It’s the perfect time to teach them the value and importance of saving and investing. To help them understand how you earn money and how quickly it goes away if you decide to spend it on Starbucks or cheap ass jewelry from Claire’s. To make them really realize that we, as parents, are not money trees. We work for our money, and they shouldn’t expect us to throw it around on unnecessary things, just because they want them.

I thought I would share how we are going down the path of educating our girls about money. We started this when they were 12 and 8 so maybe not all of our approaches apply to your nuggets (if you have any). But you can easily tweak based on ages.

And I am by no means an expert. My goal is simply to inspire you to take action and maybe even read the book too and become inspired just like I was.

First, they needed to understand limits

My kids ask for shit constantly. A trip to any store results in me saying “No” at least 10 times. Legit, we walked into GNC one day and my kids managed to find something they needed to have amongst the diet shakes and fish oil supplements. “Ooooo Mom, can I have this pill organizer? It would be perfect to store and organize my slime supplies.” WTF? Is no store safe from these assholes?

Whether it’s the incessant need for sugar, new jeans even though I just bought them 3 pairs a couple months ago, 75 velvet scrunchies in color shades that will never match anything in their closets, or 700 calorie Frappuccinos from Starbucks, my kids want it all, all the damn time. They are legit money-sucking leeches who will run you broke. These things add up. So, I drew the line. From now on, I only pay for things they NEED. Like food, school supplies, new bras because theirs keep growing out while mine just keep growing down. (Yes, I may have chest envy).

But these things have their limits. For example, new soccer shoes should only cost $40. When my oldest, Gianna, needed a new pair of cleats for soccer season, $40 was her budget. Of course, diva that she is, the girl only wanted the $60 pair of Nike cleats with the sock-fit collar. Guess what. I paid the $40, and she bucked up the $20 difference.

What’s this teach? That there is a difference between what you need and what you want. She needed shoes, but she didn’t need the $60 shoes. Because she wanted the $60 shoes, she had to REALLY want them enough to fork $20 out of her own pocket. She decided that they were worth it, but it wasn’t an easy decision for her….which made me proud.

Second, they needed to earn money

God, kids get money thrown at them. Maybe it’s only my kids but I feel like it’s constantly raining twenties around here. Birthdays, holidays, the tooth fairy, random people that give them cash because they simply exist in this world. Seriously, how am I supposed to teach them that money doesn’t grow on trees when left and right they are getting cash for doing absolutely nothing? It’s hard, but you can’t give up.

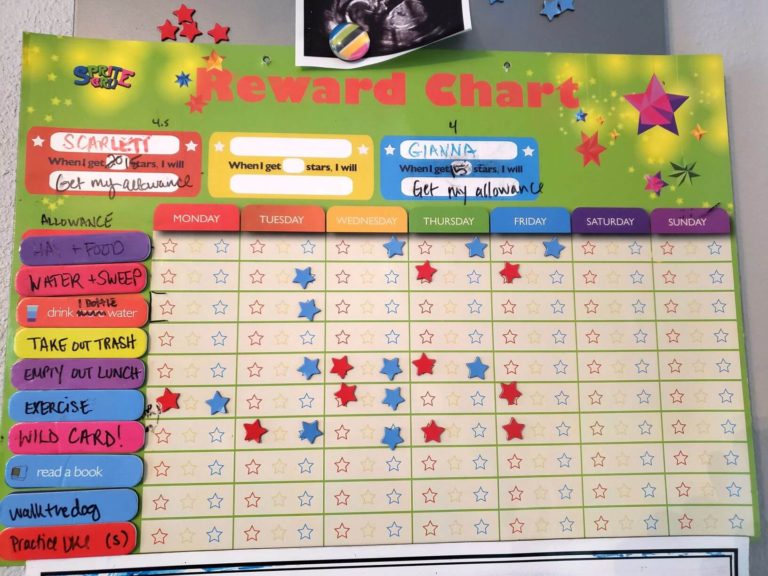

My way of doing this is setting up a small weekly allowance based on a reward chart. Each week, they have to earn 15 stars in order to get their $5 allowance. These stars are pretty damn easy to earn if you ask me. Being a functioning human will almost give you 5 stars alone. They can earn a star by reading a book, drinking water, or exercising. So I’m reinforcing healthy choices, not just chores. But they also earn stars by taking care of the pets and emptying out their lunch box when they get home.

The point of the chart is to tie the money I am giving them to important choices. I don’t really care at this point if they don’t do tons and tons of chores at the house. They half-ass almost everything anyways. It’s more important to me that the money is tied to something tangible.

Third, now they need to think about where to put their money

Most of us just think of money in terms of how we can spend it. What we can buy. But that is a dangerous way to live. I did that for so long and it makes me want to barf just thinking of all the crap I wasted my money on. Especially before I had kids.

Now, any time my girls get money, I make them decide what they want to do with it. There are 4 ways you can allocate your money: Spend, Save, Give, or Invest. At first, we made 4 physical banks so they could visually see where their money was going. We bought cheap glass jars at the dollar store and labeled each bank with foamy stickers. I made a craft out of it, and they had fun decorating their own banks. However, there’s also this really cute piggy bank on Amazon that has dividers. Would be great for littler kids and for those who don’t want to deal with make-your-own.

- Spend – money for all the crap that you want to buy but don’t really need.

- Save – bigger purchases that you need to save up for in order to afford. Like Gianna’s iPhone 11 that she had to have even though her Samsung 7 was perfectly fine. I was not paying for it, so she slowly saved up her cash until she had enough.

- Give – money for donating to causes that are important. Scarlett has such a huge heart. She is always putting money in here and gives it to people she sees on the street or kids coming around the neighborhood who are raising money for some cause. It’s more special, because this is her money she is giving and not ours. For reference, Gianna only has like $1 in her Give bank. I still need to work on her charitable nature. It doesn’t come natural to her. Just try asking her for a piece of gum.

- Invest – money that you are committing to save for a long time. This goes in an interest-bearing account and is not touched for anything. For me, this is the most important account of the 4.

Any time money is flung their way, they need to decide what to do with it. I let them make their own choice, with the only caveat that each month they are required to put at least $5 each in their Invest account. Because investing is soooooo friggin important. We taught them that you can use your money to make money for you. Just by putting it into an account and not touching it. Every month, I would remove the dollars from their physical banks and move it to a high-interest savings account that we opened for each of them. We use TAB Bank. It’s the best interest I’ve found (was 2.5% when I opened, currently 1.9% as I write this).

I print out their statements occasionally and show them how, month over month, their interest earned keeps getting higher, because their balances keep growing. They nerded out a little when they saw how their money was making money, and they literally had to do nothing. It’s the dream, right?

Such a simple thing, but kids don’t normally get this level of info at their age. I know I didn’t.

For example, my husband Vince seriously started saving for his unborn children when he was like 13. This was also around the time he got his first job washing cars for a local funeral home, among other side hustles. That’s part of what made me fall in love with him 20 years ago. His drive and his commitment to giving his kids the best, while he was still a kid himself. I mean, what 13 year old do you know that is already saving for their future kids?

However, what kills us both now is the fact that all of this money just sat there. In envelopes and empty protein powder jars. How much more money would our girls have now if we were educated about the importance of putting your money in a high interest bearing account? Or even if we invested in stocks?

There’s still struggle

I teach the girls all of this because no one else is….however, I do still have an internal struggle at times. Mainly because I hate the way it sounds when they ask about how much something costs.

To me, when I hear that, my mind first goes to the thought that it sounds like we are poor. Why else would my kids be concerned with money at this young an age? I have to get rid of that stigma in my own mind. I grew up poor, so money was always a source of stress for me. I remember being a kid and going to the car wash to open the vacuum machines to hunt for change people sucked out of their cars when cleaning. I don’t want any piece of that lifestyle for my kids. I want them to have more. I need to tell myself that they aren’t “worried about cost” but rather are “aware of cost” and that’s very, very different.

Give it a try

I seriously urge you to read the book if you haven’t. Get the audio version if you aren’t a huge reader. Listen to it in your car during your commute or during your daily walks. Whatever. Just give it a go and let me know what you think after. I’ll nerd out with you and am here to give advice if you want it!

Along with helping me see that it’s my job as a parent to educate my kids about money, it also fueled me to manage my own finances better. You would think I would be amazing at that already, given that it’s a part of my real world job. However, I kinda suck. Before reading this book, I didn’t have a savings account at all. My overdraft protection was used monthly in between pay periods because I refused to really budget my costs/income. That still sounds sooooooo boring to me. I don’t want to do it at all.

But now, I have a Roth IRA that is auto-funded monthly, my 401K is rocking, and I have a savings account that’s earning decent interest. My next goal is to invest in some stocks. I haven’t gotten there yet because that’s next level adulting and I’m still learning. The money you can make in the stock market is crazy. I still don’t have a household budget, but my overdraft account hasn’t been used since this past summer. I’ve been smarter about my purchases I guess.

Actually, maybe it’s because I’m not dropping money on all the unneeded crap my kids always used to ask for because those leeches are paying for it themselves. See? It’s a win, win. 🙂

Thanks for the great read Krissy, I would really like to read that book.

I am def getting this book. I just got green light cards for the boys and we have been increasingly aware of their lack of knowledge of how money comes in and goes out and what NEEDS to go out oppose to what’s coming in. They listen to Dave Ramsey podcasts at night and have learned so much. Dave Ramsey also has a game that’s similar to monopoly but more real life situations “Act Your Wage” .Dave Ramsey’s Act Your Wage! Board Game https://www.daveramsey.com/store/product/dave-ramseys-act-your-wage-game?utm_source=google&utm_id=go_cmp-6461376375_adg-76911263709_ad-379144276699_pla-808431042609_dev-m_ext-_prd-9780976963097OLP&gclid=CjwKCAiA-vLyBRBWEiwAzOkGVLwOU778DjEd6gjebFuv1oBhJEkhst9CB03n7oOtPdX1teKv4v5rhBoCaeUQAvD_BwE You should look into it. This is one of our favorite family game night games right… Read more »

[…] no regard for personal space or general rules of society. They think the world centers around them. They leech you of money and are never satisfied. They think they know everything but their world is so small. And you can’t hit them or […]